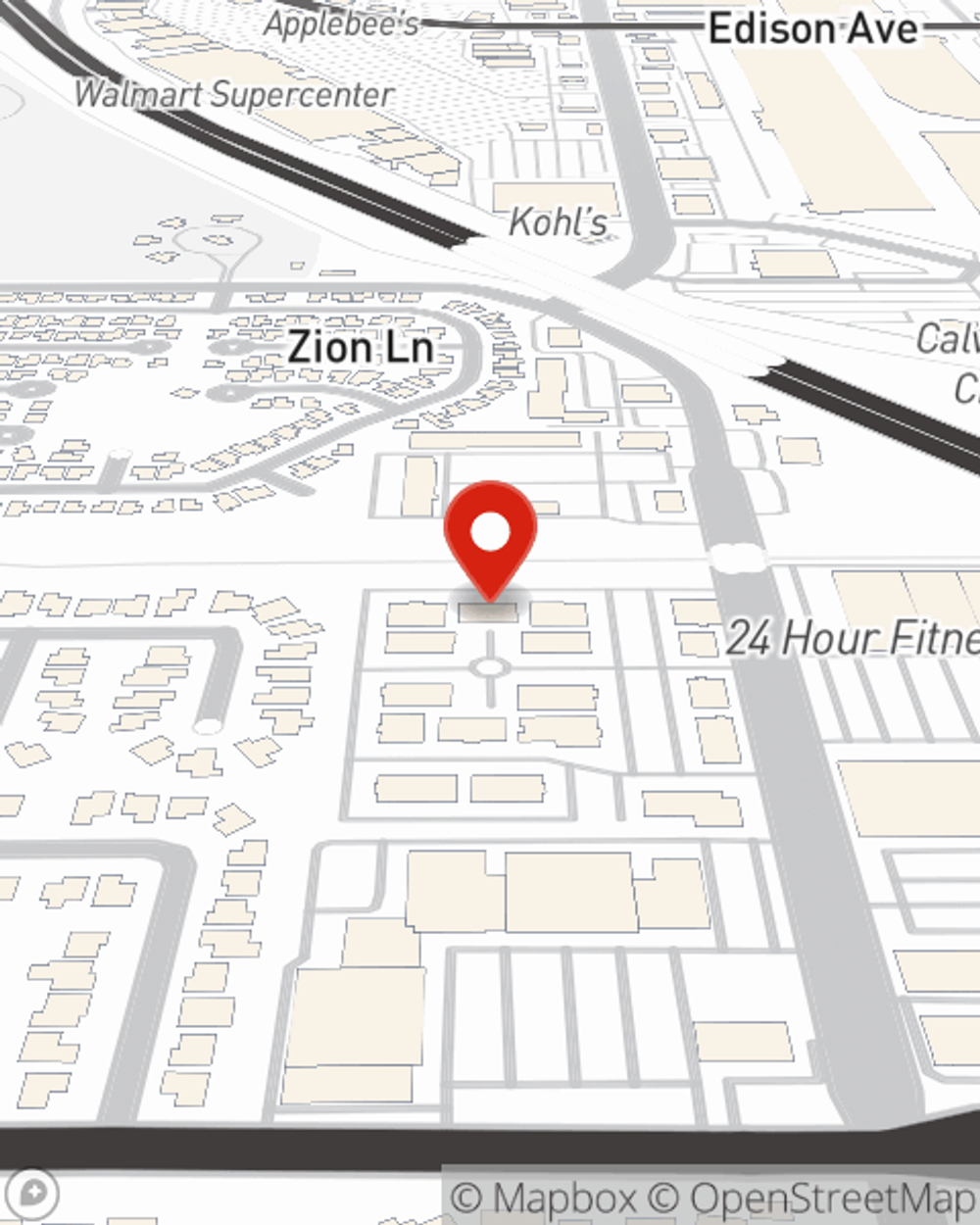

Business Insurance in and around Chino Hills

Calling all small business owners of Chino Hills!

Cover all the bases for your small business

- Arizona

- Oregon

- Nevada

Cost Effective Insurance For Your Business.

Whether you own a a window treatment store, a bakery, or a cosmetic store, State Farm has small business protection that can help. That way, amid all the different moving pieces and options, you can focus on your next steps.

Calling all small business owners of Chino Hills!

Cover all the bases for your small business

Protect Your Business With State Farm

Each business is unique and faces specific challenges. Whether you are growing an auto parts shop or a funeral home, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Kristi Kim can help with extra liability coverage as well as employment practices liability insurance.

The right coverages can help keep your business safe. Consider contacting State Farm agent Kristi Kim's office today to identify your options and get started!

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Kristi Kim

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.